Looking to Enhance Your Highly Concentrated Stock Position?

You Have Options.

NorthCoast uses proprietary stock and market exposure models along with an options overlay strategy to enhance concentrated positions. What are your investment goals? Let’s talk about how active portfolio management can help you meet your targets.

Successful investment management is a consequence of thoughtful product design, a transparent investment process, institutional operations and exceptional client service.

NorthCoast can help manage to your investment goals: generate income, hedge downside risk, initiate tax-efficient liquidation, or diversify concentrated account positions.

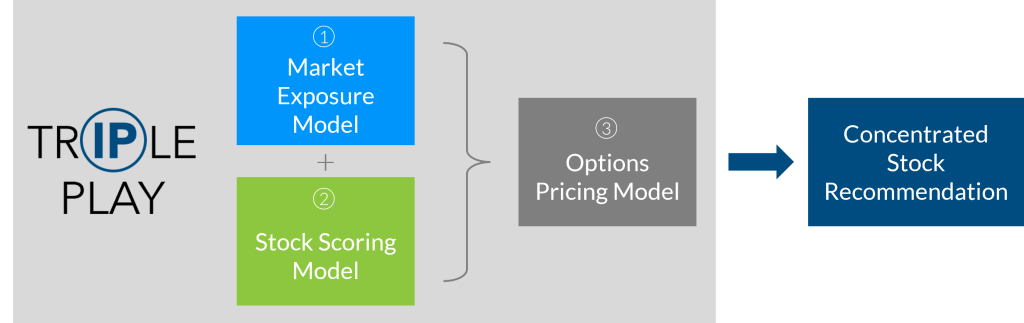

We combine three models to drive our recommendations:

A Market Exposure Model that uses 40+ signals to identify optimal market exposure levels in changing environments

A multi-factor Stock Scoring Model that discovers and interprets impactful patterns and trends to forecast stock performance vs. the market

An Options Pricing Model that leverages our market and stock model results to create what we believe is the optimal recommendation given current market conditions

For more information on the NorthCoast Concentrated Stock Plus Strategy, get an analysis of your position.

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR’S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.

Options overlay strategy does not protect from downside risk. The downside risk protection benefit of a call writing strategy is limited to the amount of the premium received. Portfolio holdings may need to be sold to generate cash to settle options. Such sales may produce tax consequences. Investors must be willing to forgo potential upside appreciation above the premium value in exchange for the incremental income. Options may expire worthless or not perform as expected, resulting in losses. Options involve risk and are not suitable for all investors. Refer to Characteristics & Risks of Standardized Options: http://www.optionsclearing.com/about/publications/character-risks.jsp